Do you interested to find 'tax administration essay'? You will find all the information on this section.

Table of contents

- Tax administration essay in 2021

- Tax evasion meaning

- Tax reform

- What do taxes pay for

- What is tax evasion mean

- Tax administration essay 06

- Tax administration essay 07

- Tax administration essay 08

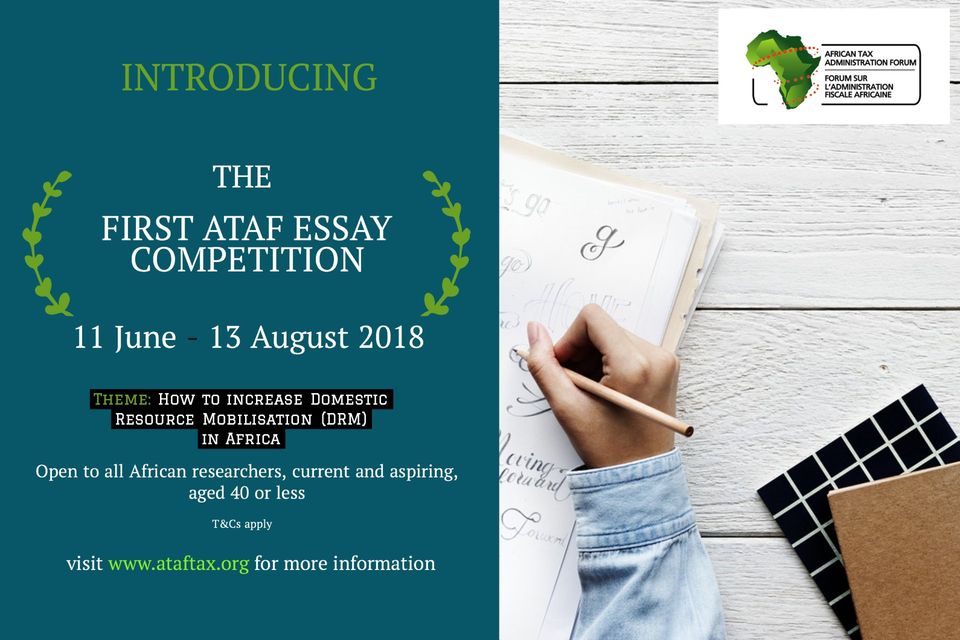

Tax administration essay in 2021

This image representes tax administration essay.

This image representes tax administration essay.

Tax evasion meaning

This picture representes Tax evasion meaning.

This picture representes Tax evasion meaning.

Tax reform

This picture shows Tax reform.

This picture shows Tax reform.

What do taxes pay for

This picture shows What do taxes pay for.

This picture shows What do taxes pay for.

What is tax evasion mean

This picture illustrates What is tax evasion mean.

This picture illustrates What is tax evasion mean.

Tax administration essay 06

This image demonstrates Tax administration essay 06.

This image demonstrates Tax administration essay 06.

Tax administration essay 07

This image illustrates Tax administration essay 07.

This image illustrates Tax administration essay 07.

Tax administration essay 08

This picture shows Tax administration essay 08.

This picture shows Tax administration essay 08.

How many words are in an essay on government taxation?

Every statute which takes away or impairs rights acquired under existing laws, or creates a new obligation or imposes a new duty, or attaches a new disability in respect of transactions already passed , must be presumed to be intended not Should The Uk Government Restore The 50 % Additional Rate Of Income Tax? Essay

What are the principles of good tax administration?

Good revenue authorities identify and assess compliance risks and develop strategies targeted at addressing those risks. These strategies include education, service, marketing, profiling risk, auditing, general anti-avoidance efforts, prosecution and proposals for legislative change.

Which is the best essay on administrative law?

Essay on the Dicey’s View on Administrative Law Essay # 1. Definition of Administrative Law: Ivor Jennings. “Administrative law is the law relating to the administration. It determines the organisation, powers and duties of administrative authorities and indicates to the individual remedies for the violation of his rights”.

How are taxes levied by the central government?

The taxes levied by the Central government are on income (other than tax on agriculture income which would be levied by the state government), customs duties, central excise and service tax. The State government levies Value Added Tax (VAT), sales tax in states where VAT is not applied, stamp duty, state excise, land revenue and tax on professions.

Last Update: Oct 2021