Are you looking for '221138711 ocean carriers case study solution'? Here you can find your answers.

Table of contents

- 221138711 ocean carriers case study solution in 2021

- 221138711 ocean carriers case study solution 02

- 221138711 ocean carriers case study solution 03

- 221138711 ocean carriers case study solution 04

- 221138711 ocean carriers case study solution 05

- 221138711 ocean carriers case study solution 06

- 221138711 ocean carriers case study solution 07

- 221138711 ocean carriers case study solution 08

221138711 ocean carriers case study solution in 2021

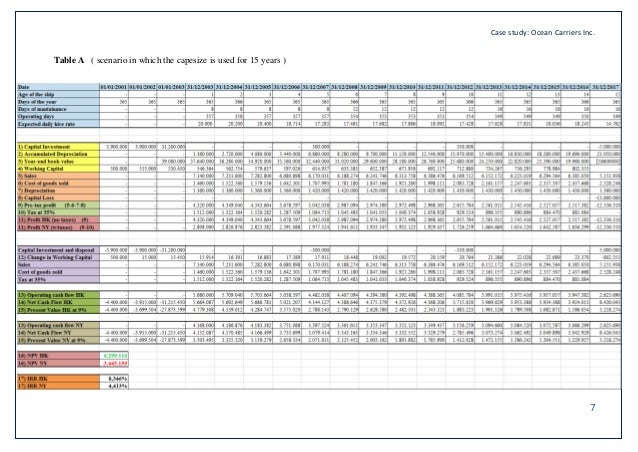

This image demonstrates 221138711 ocean carriers case study solution.

This image demonstrates 221138711 ocean carriers case study solution.

221138711 ocean carriers case study solution 02

This picture illustrates 221138711 ocean carriers case study solution 02.

This picture illustrates 221138711 ocean carriers case study solution 02.

221138711 ocean carriers case study solution 03

This image representes 221138711 ocean carriers case study solution 03.

This image representes 221138711 ocean carriers case study solution 03.

221138711 ocean carriers case study solution 04

This picture illustrates 221138711 ocean carriers case study solution 04.

This picture illustrates 221138711 ocean carriers case study solution 04.

221138711 ocean carriers case study solution 05

This image demonstrates 221138711 ocean carriers case study solution 05.

This image demonstrates 221138711 ocean carriers case study solution 05.

221138711 ocean carriers case study solution 06

This picture shows 221138711 ocean carriers case study solution 06.

This picture shows 221138711 ocean carriers case study solution 06.

221138711 ocean carriers case study solution 07

This picture representes 221138711 ocean carriers case study solution 07.

This picture representes 221138711 ocean carriers case study solution 07.

221138711 ocean carriers case study solution 08

This image representes 221138711 ocean carriers case study solution 08.

This image representes 221138711 ocean carriers case study solution 08.

What is the baseline case for ocean carriers?

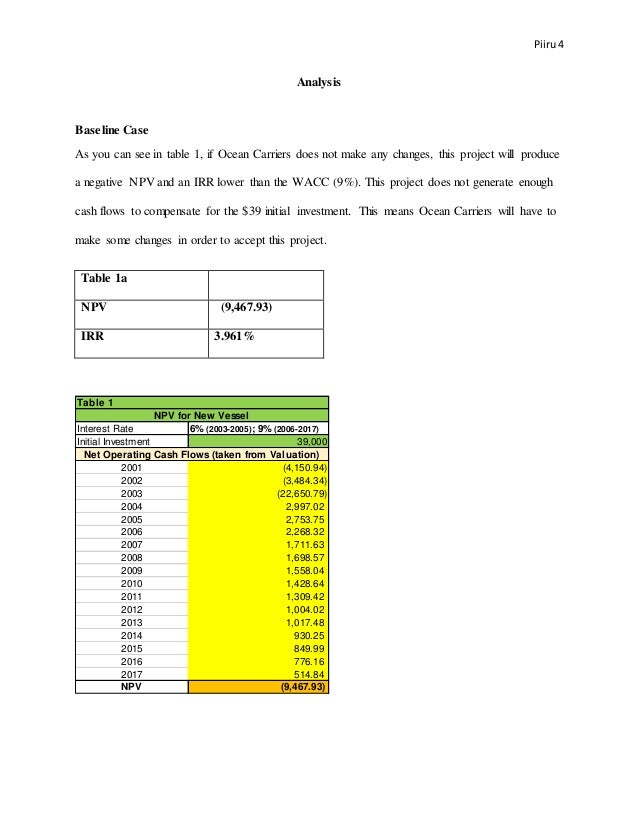

Piiru4 Analysis Baseline Case As you can see in table 1, if Ocean Carriers does not make any changes, this project will produce a negative NPV and an IRR lower than the WACC (9%). This project does not generate enough cash flows to compensate for the $39 initial investment.

When to consider operating costs when hiring an ocean carrier?

If for some reason, operating costs were to become much higher than expected, Ocean Carries should take this into consideration when determining the daily hire rate. The factors above are what help influence the daily hire rates, and although they are not conclusive and completely reliable, they will guide the decision making process.

How does the economy affect an ocean carrier?

When the economy is booming, most likely production and demand for iron ore and coal will increase. Also, changes in trade patterns affect the demand. For example, if the distance between the supply and the destination increased for iron ore, demand for capesizes would also increase. Finally, operating costs can also influence the daily hire rate.

What is the corporate tax rate for ocean carriers?

Piiru3 Assumptions Ocean Carriers has offices in both Hong Kong, China and the United States, but the shipping company is headquartered in the United States; so, I used a 35% corporate tax for my baseline case calculations. This I a major difference from the corporate tax rate of 0 in Hong Kong.

Last Update: Oct 2021

Leave a reply

Comments

Dianthe

19.10.2021 09:44Orchard apple tree inc five forces analysis porter's exemplary panmore. According to the article, the provision of ships gettable equals the bi of ships presently in the swift plus.

Layman

22.10.2021 12:07If you have some query so you can feel free of contact with us. Study questions reviewessays com.

Faiz

23.10.2021 09:39In that location are several websites on the cyberspace that ocean carriers case study resolution excel would sea carriers case cogitation solution excel fling you affordable packages for the avail they are providing. Ocean carriers case cogitation case solution, should ms.